Financial Management Tool

Take control of your finances with our integrated personal financial management (PFM) tool.

LOOKING FOR A SIMPLE WAY TO MANAGE YOUR FINANCES? OUR PFM TOOL IS THE PERFECT SOLUTION.

Our Personal Financial Management (PFM) tool is now available on our Online Banking App!

The PFM tool is an enhanced dashboard within the Online Banking App, which takes financial wellness to the next level.

How the PFM tool works:

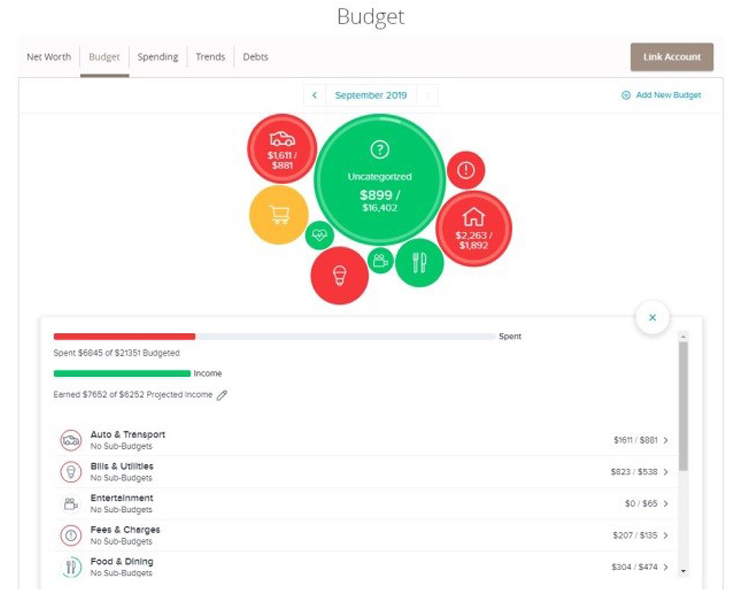

• Automatically creates a budget based on your spending habits, bills and income.

• Updates and categorizes transactions, creating a picture of how the user spends their money.

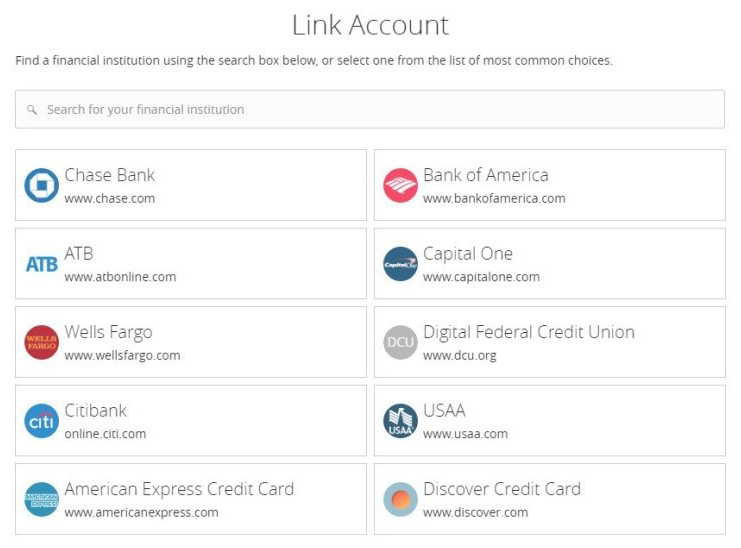

• Link external accounts, like checking accounts, credit cards, retirement accounts, mortgages or loans and more!

• User may also compare their expenditures as far back as a year’s time.

PFM (Personal Financial Management) is available to all Online Banking users for a monthly service charge of $1.50 per user. If you are not an online banking user, you can learn more about Online Banking here. User must add at least one non-CNB account (an external account) to be considered an “active user.” If in six months, the user has not added at least one non-CNB account, which would recognize them as an “active user,” then the user will be considered inactive and the feature will be deactivated from their account. Deactivation is not permanent and user may enroll again by accepting the agreement, located within the Budget/Spending widgets, followed by adding an external account.

PERSONAL FINANCIAL MANAGEMENT TOOL Features

Link External Accounts:

Take control of your finances with our integrated personal financial management (PFM) tools.

Budgets, Spending & Trends:

Create budget categories to stay on track and plan for wherever life takes you.

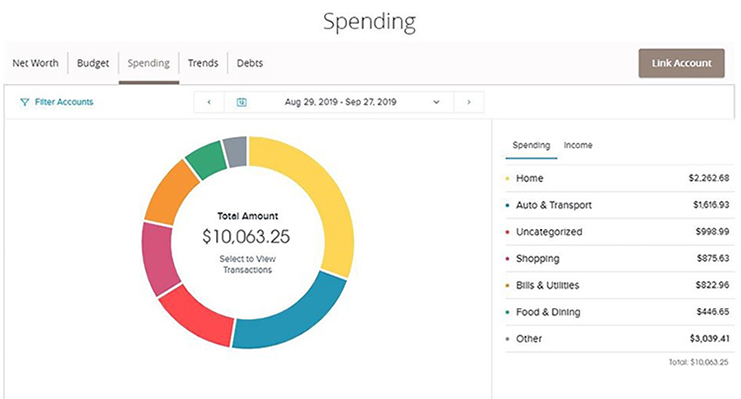

Spending & Trends:

Track your spending to see where your money is going each month and analyze trends to better know your spending habits.