Autobooks from City National Bank

Take Control of How Your Customers Pay You!

City National Bank now offers digital invoicing and payment acceptance, powered by Autobooks — an easy-to-use solution that includes everything you need to get paid directly into your checking account. For added convenience and security, you can access these powerful features right inside online and mobile banking TODAY.

Access inside online and mobile banking now and try it for yourself!

Share your secure payment link by text message, or place it on any web pageCreate and send digital invoices that are customized and professional

Receive customer payments directly inside your checking account

View all your transactions and payments inside online or mobile banking

HOW TO ENROLL OPEN AN ACCOUNT

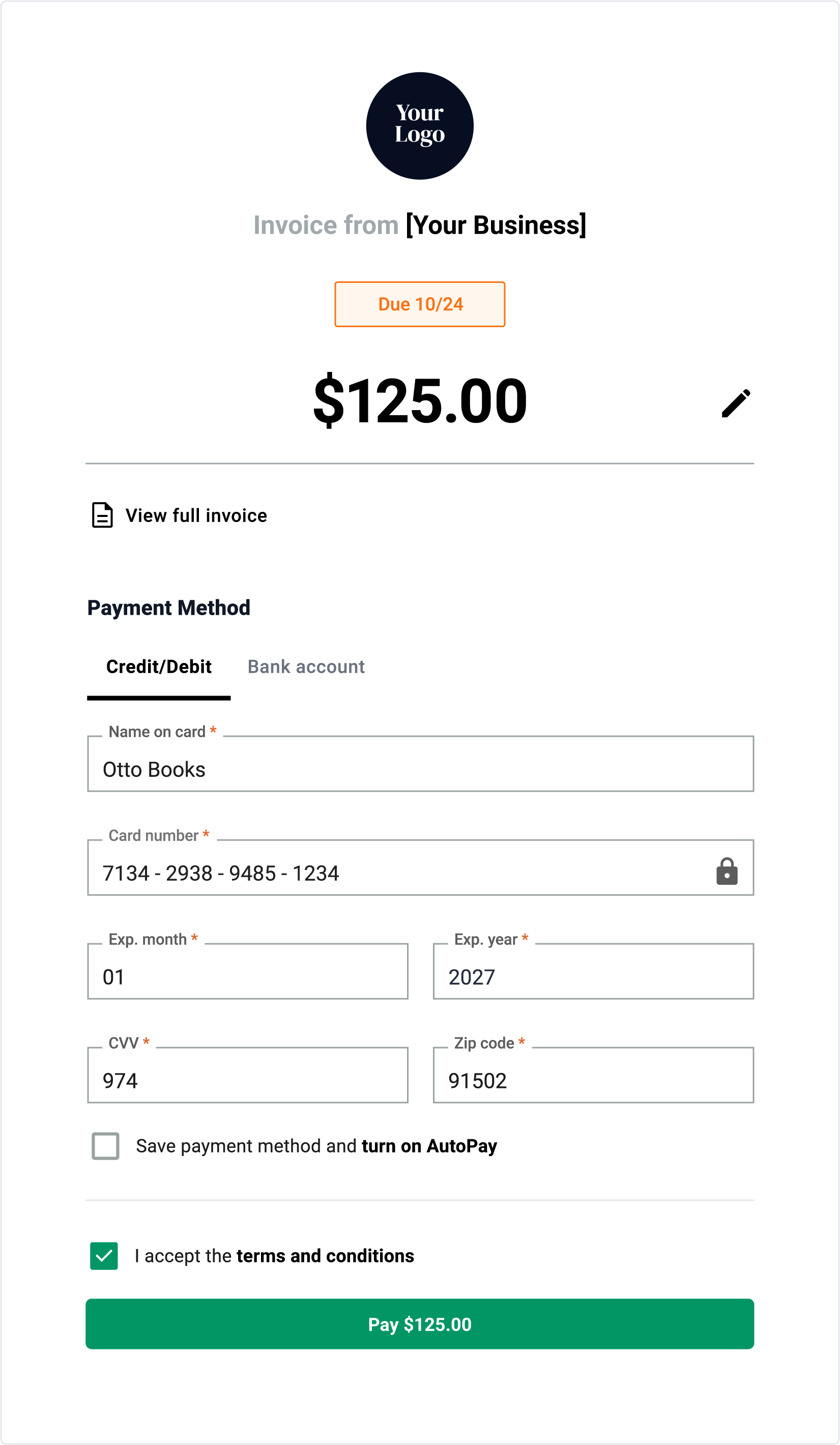

Invoicing

Send a professional invoice and get paid — all in the same place.

Customized invoice includes branding

Create a professional‑looking invoice with your business logo and colors in just a few minutes. Your financial institution’s logo is included at the bottom for added credibility.

Wide range of digital payment options

Let customers easily pay you online with any major credit card (including American Express®), debit card, or via ACH electronic bank transfer.

All payments deposited into checking

Get paid directly into your checking account within two business days — no need to transfer your money from external payment acceptance apps.

Easy invoice automation and tracking

Always know exactly who’s paid and who’s due. Set up recurring invoices so you can automate your process and automatically add late fees for past due invoices.

Secure Payment Link

Share a secure payment link by text, or place it on a web page.

Secure payment form accessed via a unique URL

When you enroll, you’re assigned your own unique URL to a secure payment form. This link can be shared by text (SMS) and email, or added to any web page or social media profile.

Detailed payment/donation history readily available

Payments are listed chronologically, with the most recent at the top. Filter the list to find specific payments. Generate a spreadsheet if you need it, and export with one click.

Pay now language can be adjusted for nonprofits

If you run a church or nonprofit, there’s no need to alienate members — quickly update verbiage to take donations or contributions instead.

All payments deposited into checking

Get paid directly into your checking account within two business days — no need to transfer your money from external payment acceptance apps.

In-App Payment Acceptance

Take customer payments on the spot or over the phone.

Payment form doubles as an in‑app terminal

When you’re ready to take a digital payment, just access your payment form inside online or mobile banking, and enter the payment details yourself.

Free standalone mobile app available for Apple or Android

Download the free Autobooks app, via the App Store or Google Play, and access your unique payment form anytime you need to collect a payment.

Transparent processing fees in comparison to non-bank apps

When you're a small business, you need to know exactly what you're paying. Our rates are comparable to popular payment apps, but there are never any hidden fees.

All payments deposited into checking

Get paid directly into your checking account within two business days — no need to transfer your money from external payment acceptance apps.

Payment Acceptance via QR Code

Display your unique QR code to make it easier for customers to pay.

Reusable QR code is ready to download

Access a reusable QR code inside online or mobile banking. Download and store in your device for easy retrieval, or just print it and display in a prominent location.

Ideal for busy events

QR codes are ideal for in-person events where you plan to meet with multiple customers or donors — farmers’ markets, fundraisers, you name it.

For paper and static invoices

If you send PDF invoices and other billing communications to customers, don’t forget your Autobooks QR code. It doesn’t make a difference if it’s a paper or email invoice.

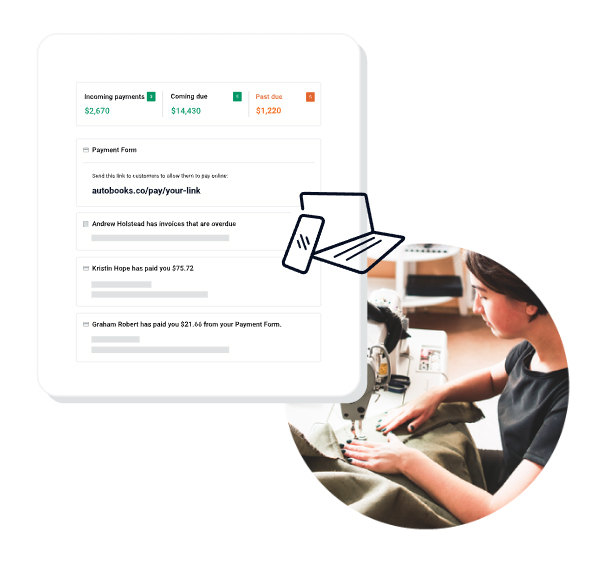

Accounting & Reporting

Add on full financial management functionality when you’re ready.

Real‑world accounting tools prioritize simplicity

Keep track of your business directly inside online banking and mobile banking. Stop having to rely on pen and paper, spreadsheets, or overly complex accounting software.

Automated reporting to keep everything up to date

When you get paid or pay a bill, let Autobooks update your business reports automatically. Also get profit and loss reporting that tracks your income and expenses, balance sheet, and more.

Cash flow management to track incoming and outgoing

Track your account balance right alongside your incoming and outgoing payment information. Includes scheduled payments, coming due, and past due payments.

Business bill pay to keep expenses top of mind

All bills managed in one place: create, track, and schedule. Users can create a list of vendors, then simply set up and schedule payments and track who they've paid and who’s coming up.

Use Autobooks

How to: Invoicing with Autobooks

How to: Accept in-person, contactless payments with emv on iPhone

How to: Accepting a Payment with Autobooks

How to: Accept in-person, contactless payments with emv on iPhone

Accounting and Reporting with Autobooks

Invoicing with Autobooks

Payment Link with Autobooks

Invoicing and Payment Link by Autobooks

Start Getting Paid

Get Paid with an Invoice

Get Paid with Payment Link

Get Paid with EMV on iPhone

EMV on iPhone: Best Practices from Autobooks

Fees | FAQs

Card-Not-Present Payment

When you manually key in your customer’s card details or when a customer makes a payment online by entering their own payment details.

Time of Deposit: 1-2 business days

3.49% Processing Fee*

ACH or Electronic Check Payment

When your customer opts to pay through a bank transfer or via electronic check.

Time of Deposit: 1-2 business days

1% Processing Fee*

*This is a typical rate, but may vary based on the partnering financial institution. Please contact your bank or credit union to learn more.

Making payments online is usually more convenient and more secure for your paying customers. In addition, funds are deposited directly into your checking account within 1-2 business days for card and ACH, and the same day for optional real-time deposits. With Autobooks inside your online and mobile banking, you can easily track payments and invoices — providing you a quick overview of your cash flow.

Processing fees are an industry-wide standard when accepting online payments, and are taken out of each payment that is processed before being deposited into your account. As a payment processor, Autobooks offers some of the most competitive rates on the market, with processing fees as low as 3.49%* for card payments and 1%* for ACH payments.

*This is a typical rate, but may vary based on the partnering financial institution. Please contact your bank or credit union to learn more.

Only one fee is applied, unless you decide to activate the optional real-time deposit feature. There are no additional processing fees when accepting online payments from customers.

Absolutely! Our small business experts are here to help answer any questions and guide you every step of the way. Contact us at support@autobooks.co or by phone at (866) 617-3122.