- Routing Number: 103100739

- En Español

- Contact Us

- (866) 385-3444

Get Immediate Access To Your Funds With An Instant-Issue Debit Card.

City National Bank & Trust’s Visa debit card provides convenient access to your funds at any point-of-sale terminal that displays the VISA symbol and any Cirrus ATM Network.

Pay online the easy way with Visa SRC and a City National Bank Visa debit card.

More on Visa SRC

Report Lost or Stolen Card:

Please contact customer service toll-free at 1-866-385-3444. If it is after regular business hours, please select option “1” from the menu to report your lost or stolen card.

You’re Not Ordinary. Why Should Your Debit Card Be?

Nearly everything you own is an expression of who you are… except for your debit card. Well, that doesn’t have to be the case anymore.

View Card Gallery

A Safer, More Secure Card Is Here!

We are pleased to announce the arrival of a new, better Visa debit card. CNB’s new Visa EMV debit card is a safer, more secure option for point-of-sale purchases. That’s because each card contains a small chip that generates a unique code every time you use it at a chip-enabled terminal. This technology makes it extremely difficult for counterfeiters to steal your account information.

More on Chip Cards

Your CNB chip-enabled card is free when you open a new checking account or replace an expired card. Don’t want to wait until your card expires to get a new EMV card? No problem! You can replace your card anytime for a $12 fee!

Shop Securely, Every Time.

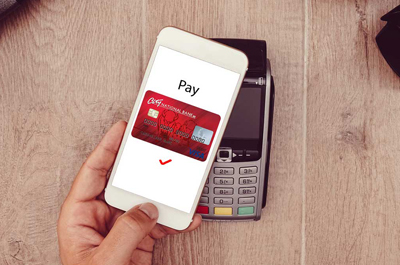

We know that flexibility and convenience in making purchases is important to you. That's why digital wallet is a perfect solution for your busy lifestyle. You can still enjoy your card's rewards, benefits and security, but now, shopping is easier than ever!

After you select which app is right for you, upload your eligible City National Bank debit card, and make fast, secure digital payments right from your phone.

Digital Wallet Options

What we Offer A Visa Debit Card comes with these features.

-

Included with Any of Our Checking Accounts

-

Accepted worldwide at a multitude of locations

-

Convenient 24/7 access to spending your money

-

Card Control with CityNET Online Banking – freeze, disable or activate cards

-

Use your Visa debit card at any Cirrus ATM network

-

Digital Wallet allows you to make payments easier than ever.

Report Lost or Stolen Card

Please contact customer service toll-free at 1-866-385-3444. If it is after regular business hours, please select option “1” from the menu to report your lost or stolen card.

Visa Fuel Dispense Hold

VISA will be increasing the dollar hold limit at the gasoline pumps to $25 per transaction. This change was implemented in an effort to reduce the number of self-service fuel pump “shut offs” that directly affect cardholders.

• We will charge against your account all purchases made with your card.

• Cash withdrawals are normally limited to $400 per business day, per account. Purchases with your CNB debit card are normally limited to $1,000 per day per account, as long as your available balance is sufficient to cover the aggregate of all purchases. This is a security feature to protect both you and City National Bank & Trust in the event that someone attempts to use your card without your approval. Upon customer request, withdrawal and purchase limits may be temporarily raised to accommodate your spending needs.

• As with any banking transaction, City National Bank & Trust will limit the amount of withdrawals to currently available balances and all deposits are accepted on a provisional basis, subject to collection through normal banking procedures.

• You cannot place a stop payment on any transaction made with your card.

• There are no limitations on transactions between your own accounts.

• We reserve the right to refuse cash withdrawals.

• You may only use your debit card to charge purchases against the account designated with your request for the card.

• Your card may not be used for any illegal transactions.

• We reserve the right to cancel your card.

• Transactions denied because of insufficient funds will result in a charge of $1.00 per denial.

To protect your account, we monitor your VISA debit card transactions for potentially fraudulent activity which may include a sudden change in locale (such as when a U.S.–issued card is used unexpectedly overseas), a sudden string of costly purchases, or any pattern associated with new fraud trends around the world. We also monitor online transactions, such as with Online Bill Pay, for possible fraudulent activity.

If we suspect fraudulent VISA debit card use, we’ll be calling you to validate the legitimacy of your transactions. Your participation in responding to our call is critical to prevent potential risk and avoid restrictions we may place on the use of your card.

• Our automated call will ask you to verify recent transaction activity on your card.

• You’ll be able to respond via your touchtone keypad.

• You’ll also be provided a toll-free number to call should you have additional questions.

Our goal, quite simply, is to minimize your exposure to risk and the impact of any fraud. To ensure we can continue to reach you whenever potential fraud is detected, please keep us informed of your correct phone number and address at all times.

In the meantime, please be diligent in monitoring transaction activity on your account and contact us immediately if you identify any fraudulent transactions. An easy and convenient way to monitor your account is through online banking and the use of eStatements.

Please contact customer service for more information or if you think your account has been compromised in any way toll-free at 1-866-385-3444.

Gallery fee ($14)

Decline fee ($1)

Replacement fee ($12)