HOW LONG SHOULD I KEEP MY TAXES?

Piles of paperwork have a tendency to multiply overnight. One day we look across our desk and ask, where did all this come from? In this season of filing taxes, maybe it’s also time to file away all that paperwork so you can see the top of your desk once again.

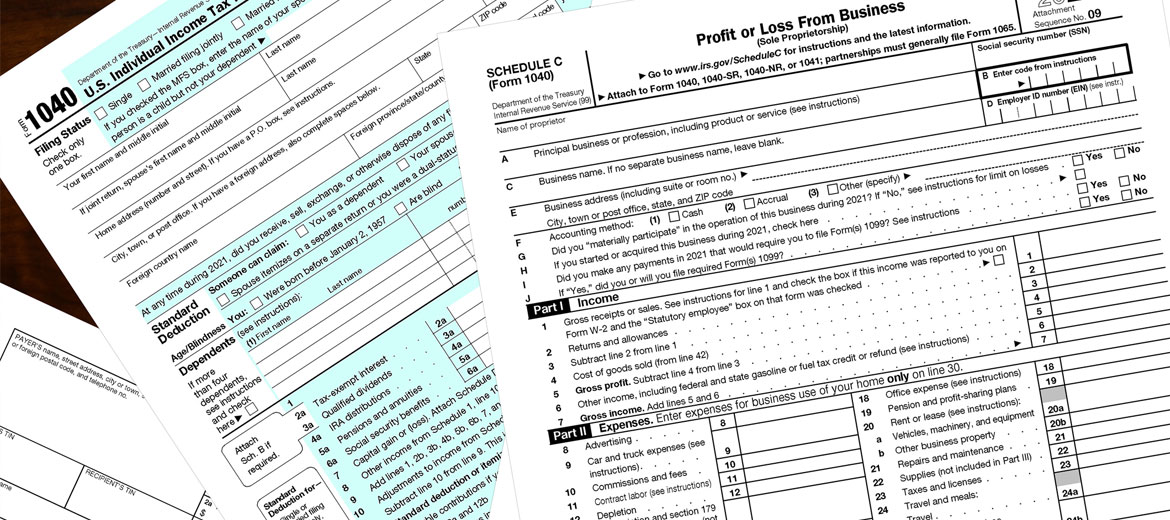

But what about the tax papers? Should you just trash them or keep them in case of an audit? In this blog, we’ll discuss how long you need to keep your tax records and what to do with them now and in the future.

How Long Should I keep Tax Records?

The IRS statute of limitations states that you need to keep your tax records for a period of not less than three years. You should also check your state regulations for tax record retention if your state collects a State Income Tax. Currently, there are 42 states that charge a State Income Tax.

Which Tax Records Should I keep?

As a general rule, you should keep all documents related to your tax records. This includes W-2s, 1099s, receipts, mileage logs, itemized deduction records, etc. Every item that you submitted when you filed your taxes should be kept with that year’s tax records.

Are there Exceptions to the Rule?

Yes. In some cases, you may want to hang onto your tax records for a period of seven years. For example, plan on keeping your tax records for any retirement accounts, such as 401Ks for at least seven years after the account is emptied or closed.

How Should I Store My Tax Documents?

Tax records are one of the most important set of documents that you possess. Safeguarding them should be a high priority. Not just for audit purposes, but also because of the sensitive information contained in them. You may want to invest in a fire-proof safe or lock box that you can hide somewhere in your home. Another alternative is a Safety Deposit Box at your local bank.

What is the Best Way to Get Rid of My Tax Records?

Before you get too excited and start a shred party every three years, you may want to check with other businesses that you deal with. For instance, some creditors, insurance companies, etc. may have a longer statute of limitations than the IRS does. When you are ready to start shredding your old tax forms, you may want to invest in a “Cross Shredder” as opposed to a simple “Inline Shredder.” Remember, these tax documents contain a great deal of your personal information. You don’t want that information falling into the wrong hands.

On a Side Note:

As you prepare to receive your tax refund, we want to remind you that City National Bank cashes tax checks. Here’s what you should know:

• You must present a photo ID to cash a tax check.

• If the check is made out to multiple people with the word “and,” then all check owners must sign the check to deposit it into an account they each own, or all parties must be present with photo ID to cash the check.

• Non-customers can cash their tax check at CNB. There is a small fee of 4% (minimum fee $10) of the check, whichever is more.

Thank you for being a valued customer!

Disclaimer: The information posted on blogs and vlogs by City National Bank is for educational and entertainment purposes only and is not intended as a substitute for professional or legal advice. City National Bank will not be held liable for any loss or damage of any kind in connection with this blog.